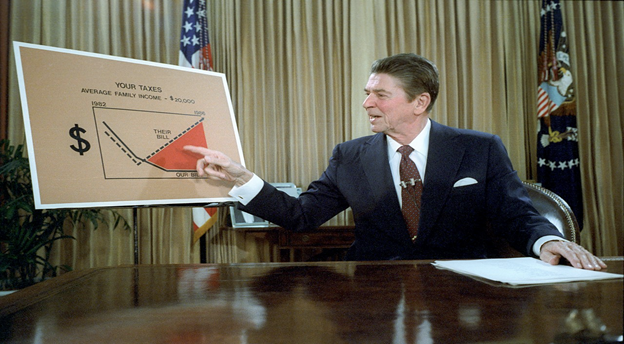

Reagan’s tenure as president, when viewed through an economic lens, is generally one of his most celebrated aspects. Surface level analysis may lend this credibility, but the reality is much different. Deregulation, union busting, tax cuts for the wealthy and increases in the national debt provide a different story. This, along with an analysis of the true nature of capitalism and its effects on the working class show Reaganoics and its hero, free market capitalism, is not the force for good some may believe.

Per the Reagan Foundation, “To reverse the economic climate of the time, President Reagan put forth an economic policy which aimed to reduce government regulation, lower taxes and promote free-market capitalism as a means to stimulate economic growth and increase individual wealth.”

Similar to personal responsibility’s role in social policies, Reagan’s economic policy, or Reaganomics, was largely predicated on the idea that giving the wealthy more money would “trickle down,” resulting in more jobs being created, higher wages for employees and more. Giving the owning class more money allows lower classes to reap the benefits.

This school of thought came out of the desire to separate from New Deal and Great Society policies. “By the 1970’s, the country had applied the same set of solutions to all the new problems that arose … new problems came up,” said Dr. Adam Cayton, a UWF professor. “The public perception was that they weren’t as appropriate to the world of the 1970’s … so Reagan is riding the wave of the backlash, the desire to go the other way … the politics of the 30’s and 40’s had run its course, you can only do the New Deal so many times.”

I am going to proceed by examining the tenants provided by his foundation. First, changes in government regulation. This happened along a variety of metrics throughout the Reagan administration. Observable aspects include actions against labor unions, along with removing health care regulations, bank regulations and environmental regulations.

Unions were and are instrumental for giving workers bargaining power against corporate interests and wealthy business owners, effectively giving a voice to those who wouldn’t have one without. Such victories include child labor laws, the minimum wage, workplace safety laws and the 40 hour work week.

One of Reagan’s first actions in office came in August of 1981. A strike was commenced by the Professional Air Traffic Controllers Organization, or PATCO, on the basis of low wages and long hours. Reagan issued an ultimatum, giving the workers 48 hours to return to work or else they would face termination.

The workers did not return, and Reagan laid off over 11,000 of them, declaring them unable to work for the government again. This might seem insignificant, but it showed business owners and corporations that union busting was fair game again. Coupled with Reagan appointing personal allies to the National Labor Relations Board, which oversees union activity, the mass layoff opened the floodgates. Since his actions in 1981, union membership has declined continuously, finding us with the lowest percent of unionized workers in American history today.

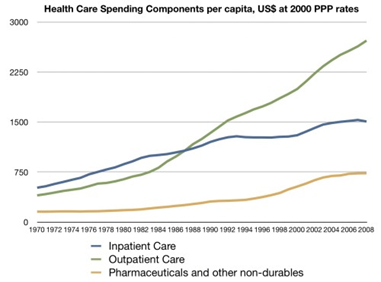

Reagan’s predecessors, including Jimmy Carter, contributed to increasing healthcare regulations and federal involvement in cost setting and funding. Healthcare expenditures then, as they do now, make up a large portion of government spending. As a plan to save the country’s money, Reagan began dismantling the precedent that had been set.

Reagan, as a staunch advocate of free markets, believed that the regulations decreased competition between insurance companies. Increasing the competition and excluding the government in pricing would result in lower costs.

Instead, as deregulation persisted, payments to hospitals from insurers and Medicare shifted from a case by case approach, which covered different services with a profit left over, to a fixed cost per visit. This fixed cost, regardless of the circumstances, shifted the financial risk from insurers and Medicare to healthcare institutions and ultimately the individual in need of care.

Along with cutting their costs to maintain profit margin, hospitals began to provide more services as a way to recoup the lost money, like outpatient services with longer hospital stays.

Health care organizations had to prioritize growth in order to mitigate the higher level of risk on an individual basis. All of this resulted in skyrocketing healthcare prices for the average American. The increasing prices have continued, becoming burdensome in the dismal economic landscape of 2023 America.

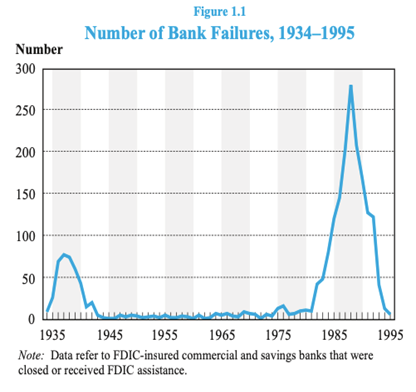

In similar fashion, Reagan also looked to deregulate the banking industry. The Savings and Loan, or S&L, crisis is a microcosm of his attitudes toward banking and their effects. Thrifts, or S&L institutions are a direct descendant of the Building and Loan, or B&L, organizations of 1700’s Britain. B&Ls were non-profit cooperatives in which neighbors pooled resources together in order to help each other afford homes and properties.

S&Ls suffered from the Great Depression, but postwar growth in America grew the thrift industry. S&L’s took deposits from members, and then used these funds for mortgages and deposits were backed by the government. The difference between interest rate payouts and mortgage payouts provided their profit. S&L’s began paying more money than what they could bring in due to deregulated interest rates, resulting in the industry stagnating in the early 80’s. The S&L industry lost $4.6 billion in 1981, and $4.1 billion in 1982.

Attempting to jumpstart the industry, Reagan signed into law the Garn-St Germain Depository Institutions Act of 1982, dubbing it the “most important legislation for financial institutions in the last 50 years.” The act allowed thrifts to put money into commercial real estate, land deals, new business ventures and junk bonds rather than only supplying home loans and taking deposits. Reagan’s tax cuts in 1981 gave benefits for real estate investors, causing the demand for real estate to surge. Throughout the early 1980’s the amount of cash thrifts kept on hand was lowered, bottoming out at 3% of investments and giving thrifts more money to lend for whatever they liked.

Reagan’s anti-regulation attitude gave S&Ls that were already experiencing lax regulations even more freedom. The Federal Home Loan Bank Board was understaffed, resulting in many thrifts escaping oversight. Per deregulation, thrifts went from requiring at least 400 shareholders, 125 of which had to be locals and none owning more than 10%, to new regulations allowing for a single owner who could reside wherever.

Thrifts went from community cooperatives to ambitious or corrupt businessmen to invest in whatever they wanted, even their own ventures, with little oversight or consequence for bad decisions.

Deregulation seemed to be working as the S&L industry boomed, making $1.9 billion in 1983, $1 billion in 1984 and $3.7 billion in 1985. In 1986, Reagan eliminated some tax benefits he granted through his 1981 tax plan, and the industry stagnated. S&Ls attempted to buy the loyalty of politicians and regulators, convincing those who made federally backed deposits with them to buy uninsured bonds with the thrifts themselves. Insolvent S&Ls were allowed to continue operating, which worsened the crisis.

As these organizations started to fail, many Americans saw their savings and retirement funds dismantled or completely stolen, while the government was on the hook for billions of dollars in bailouts. These bailouts totaled over $100 billion by the end of the fiasco, which came from taxpayer dollars. Predatory thrifts victimized these same taxpayers all in the name of deregulation.

Environmental deregulation was another hallmark of his presidency. Reagan set the tone when he was sworn in by appointing Anne Gorsuch as head of the Environmental Protection Agency and James Watt as the Secretary of the Interior. Both Gorsuch and Watt were bent on deregulation, as Reagan was, hence their appointments.

According to Greg Wetstone, the chief environmental counsel during the Reagan administration, these two were the most “intensely controversial and blatantly anti-environmental political appointees” in American history.

During his tenure with the Department of the Interior, Watt had a similar record. He was accused of reducing funding for environmental initiatives. Watt desired to eliminate the Land and Water Conservation Fund, a fund designed to increase the area of protected lands. Watt relaxed regulations on oil and gas drilling, as well as mining, even recommending protected land to be scouted for resources.

Watt recommended 80 million acres of undeveloped land be used for the resources underneath by the year 2000. As a result of these attitudes, coal mining quintupled during his term, along with increases in oil and gas drilling. Watt even refused to accept donations of private land to be used for conservation.

This all came to a head during a meeting with the U.S. Chamber of Commerce, in which Watt remarked “We have every kind of mix you can have. I have a black, I have a woman, two Jews and a cripple. And we have talent,” when his board overseeing coal mining leases was called into question. This statement resulted in his termination.

Gorsuch made a push to reduce the EPA’s budget, cutting it by 22% over just 22 months. She fired numerous employees she saw as unneeded, doing away with entire programs like noise control. The EPA under Gorsuch filed fewer cases against polluters, relaxed the standards of the Clean Air Act and encouraged the spraying of pesticides that were considered to be restricted.

In 1982, a Congressional investigation discovered the EPA had misused a $1.6 billion toxic waste Superfund. Gorsuch withheld $6 million from efforts to clean up the Stringfellow Acid Pits in Los Angeles (pictured to the left). Gorsuch did so to hurt the Senate campaign of Democrat Jerry Brown. Gorsuch became the first EPA administrator to be held in contempt of Congress due to her attempts to cover this up.

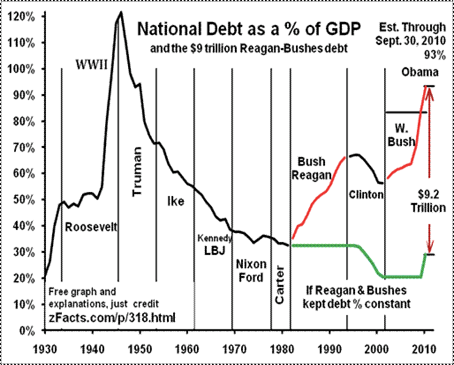

Taxes were another crucial aspect of Reagan’s supply-side economic agenda, specifically cutting income taxes for the wealthiest Americans. When Reagan took office, the top income tax rate was 73%. By the time he left office, it would be reduced to around 30%. Reagan’s tax cuts in 1981 decreased the rate corporations had to pay, lowered capital gains taxes, lowered estate taxes and decreased the rate corporations had to pay. Meanwhile, it gave them a way to escape their tax obligations through permissive depreciation.

All of these tax benefits for the wealthy were accompanied by a 4% increase in the lowest tax rate, which he increased back to the same rate in 1986. Reagan also worked to increase payroll taxes. Additionally, working class Americans were hurt by outsourcing jobs to other countries. This was not a problem until the 1980’s, but Reagan’s laissez-faire business regulation and companies’ desire to increase profits resulted in employers looking overseas. In doing so, they further escaped already weak regulation and paid less in wages and costs.

According to Reagan, these tax cuts would pay for themselves through economic growth, but the deficit grew while the government received less funding. According to Forbes, these tax cuts slashed government revenue by 2.9% of GDP. This decrease, shockingly, is even more than the decrease following America’s post WWII tax cuts. Doing away with tax policy that funded a global war lost the government less than Reagan’s tax agenda.

According to a 2022 edition of the Socio-Economic Review, researchers from King’s College in London formed a conclusion.

“We find tax cuts for the rich lead to higher income inequality in both the short- and medium-term. In contrast, such reforms do not have any significant effect on economic growth or unemployment. Our results therefore provide strong evidence against the influential political–economic idea that tax cuts for the rich ‘trickle down’ to boost the wider economy.

The following will be regarding Reaganomics’ assumption that utilizing free-market capitalism increases personal wealth and fosters economic growth. To address this, I will use the history of capitalism and the way capitalism manifests in the life of the working class.

Every issue already discussed above and in my previous article shows that Reagan’s free market capitalism and laissez-faire policies (i.e., the deregulation of industries, slashing tax rates, cutting social programs) did very little to benefit working people.

A historical analysis, and the analysis of the working experience, beyond the 1980’s, shows capitalism never has and never will prioritize interests of the working class nor widespread economic growth. Thus making the portrayal of free-market capitalism as a golden ticket during Reagan’s tenure nothing more than wishful thinking and historically unfound.

“What started to happen in the late Middle Ages is people started congregating in towns and cities, started to trade […], started to trade more, started to invent some things, started to manufacture some things,” said UWF professor Dr. Cayton. “Over time you start to have this class of wealthier people with cash—they have capital. If you’re a feudal lord you might be rich in that you own land and the people on it, but you don’t actually have money.”

The relationship between the wealthy class of non-noble born Europeans and the noble born feudal lords strained the existence of feudalism—the balance of power shifted. Cities that had wealthy individuals and were well defended without a noble lord in charge of them bargained their support for political power and representation, resulting in the House of Commons in England, for example.

“Your political rights used to depend on your name[…] but after the advent of economic capitalism and property rights, political rights and economic rights are more equal,” Dr. Cayton offered. “The critique, which appears in many different ways, is that power isn’t equal, power becomes concentrated in the hands of people who have the most capital.”

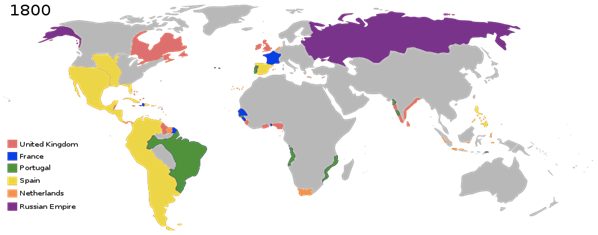

Russian revolutionary and political theorist Vladmir Lenin authored a pamphlet in 1917: Imperialism, the Highest Stage of Capitalism. Lenin’s pamphlet made the observation that imperialism is, essentially, capitalism’s monopoly stage. This stage resulted in the conquest of over 80% of the world by European capitalist powers. The Age of Imperialism began around 1500, and by 1800 European powers came to possess almost all of South America, most of North America, and had begun colonizing the coast of Africa, India, and islands in the Pacific.

The treatment of South America during this period was horrific. Europe had been denied trade routes to the East by the Ottoman Empire, resulting in Columbus’ voyage, and the expansion of Portugal, Spain, France, and Britain toward the West. Catholic missionaries were the beginning. By the end, Spanish conquistadors and Portuguese forces came to subjugate the entire continent. Portuguese imperialism created the colony of Brazil in the 1500’s. This single Portuguese colony accounted for 25% of the trans-Atlantic slave trade.

Firearms and horses, along with diseases introduced by Europeans, destroyed indigenous groups, resulting in the mass plundering of gold and silver and growing European reserves many times over. Additionally, it would mark the beginning of the trans-Atlantic slave trade, and triangular trade, in which valuable products like sugar and tobacco were monopolized and stolen by Portugal and Spain.

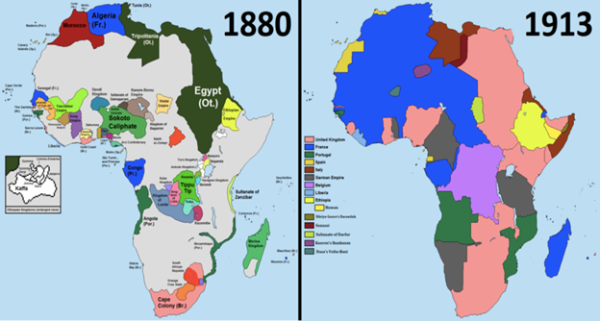

As time drew on, and South America was plundered, European powers shifted their gaze toward Africa, which was largely colonized only in coastal areas until the 1880’s. The Scramble for Africa, which occurred in the 1880’s up until WWI. This era saw France, Britain, Germany, Italy, Belgium, Spain and Portugal come to dominate almost the entirety of Africa economically and politically.

This scramble was due to technological advancements, like steamboats, and included the forced labor of African peoples, the plundering of Africa’s natural resources, and power struggles between nearly every major power in Europe. Much of Africa would continue to be colonized throughout the Cold War era.

Combining the history of the creation of capitalism and the following Age of Imperialism, capitalism has never been a school of thought keen on growing economic opportunity for everyone. Instead, capitalism was born out of the desire to increase the political power of those who had accumulated enough capital to rival the power of feudal lords. Those new political rights, afforded due to wealth, have been utilized to further the interests of the owning class at the expense of the global working class.

The economic stability and wealth most Western nations enjoy is not because free-market capitalism created it. Rather, it is because capitalism, through imperialism, violently stole from Africa, the Americas, and Asia from 1500 until today. Africa is the most natural resource rich continent, yet the most impoverished and malnourished. This global theft is then portrayed as capitalism working, as the wealth of capitalist nations has increased, but what is not included under this viewpoint is the true source of the wealth.

The concept of capitalism being a means to increase personal wealth needs addressing as well. Capitalism is often portrayed as synonymous with the creation of personal wealth, but, as it manifests, capitalism is an obstacle to increasing personal wealth for middle and lower class people.

A core idea of capitalism is the extraction of surplus value. Value is created by employees and workers throughout the day. It is the labor of the workforce. The workforce, then, takes this value they create to the owner and relinquishes it, accepting a wage, which is a fraction of the value actually created, and ceding the surplus value to the owner.

This surplus materializes in profits, dividends for shareholders who do nothing and the uninvolved owner’s pay. For capitalism to function, the worker must knowingly receive less value than the value they create throughout the work day.

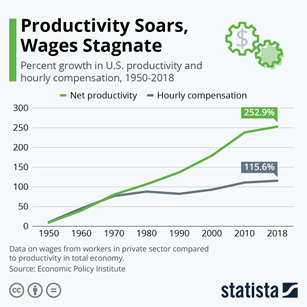

Wages in America have historically kept up with not only inflation, but also productivity. According to the Economic Policy Institute, 1948-1979 saw productivity increase 118.4% and compensation increase 107.5%. From 1979-2021, productivity rose another 64.6%, yet compensation only rose 17.3%. This increase in productivity without a corresponding increase in wages means that the owning class is making increasingly more, while workers are not seeing the fruits of their increasingly productive labor.

Economic hardships and downturns are also included with capitalist systems. The United States has experienced a recession every 6.42 years on average since the Great Depression, 14 in that time frame.

These recessions make life exponentially more difficult for both the lower and middle class. Younger workers, minority workers and workers in retail jobs, service jobs and hotel jobs often feel the effects first and harshest. Upper class individuals weather the storm due to their accumulation of wealth, being the last to get affected, but the first to recover. Below, shaded areas represent recessions.

Recessions are expected, but because they do not affect the ruling class as much as the working class, they are not seen as something we need to avoid or prevent, rather they are just part of the game.

Problems that are distinctly working class issues, like homelessness, poverty and malnutrition will never be remedied inside a capitalist system. Profit motive’s superiority to ethical and egalitarian motives means that issues that do not make money for someone in the economic food chain get overlooked.

These issues are within our power to fix. We have more houses than homeless individuals, more money than any other civilization ever, enough food to feed the country multiple times over, reserved funds to nationalize healthcare, and more. Water is a moneymaker, shelter is a moneymaker, poverty is a moneymaker and healthcare is a moneymaker. How could those starting with less or nothing, whom corporations and deregulated industries extort at every turn, be expected to grow personal wealth in a meaningful way inside a society which commodifies necessities.

Reaganomics, from widespread deregulation, to tax decreases, to complete faith in free market capitalism lifting up the working class has shown to be ineffective, even hurtful in some respects. As good intentioned as any concept or action taken by Reagan could have been, the reality is that his administration did economic damage through multiple avenues.

The effects of the Reagan-era economic policy are still felt by Americans, especially in health care costs and our current taxation environment. It is time to be objective about his actions, rather than being influenced by his larger than life persona and lasting popularity among members of both parties today.

This objectiveness about Reagan must be accompanied by objectiveness regarding our capitalist system as well. If it isn’t, we will continue to fall victim to similar politicians, policies, and rhetoric that puts the interest of the average American behind the interests of the owning class and the elite.